FTA Home Page > Energy Producing State Home > Tax Statutes

Summary Alaska

Compiled November 2014 by Ky Clark

A general description and history of Alaska’s oil and gas production tax can be found at:

http://www.tax.alaska.gov/programs/programs/index.aspx?60650

Oil/Gas Production Tax Statutes –

- AS 43.55 – Oil and Gas Production Tax and Oil Surcharge.

- There is levied on the producer of oil or gas a tax for all oil and gas produced each calendar year from each lease or property in the state, less any oil and gas the ownership or right to which is exempt from taxation or constitutes a landowner's royalty interest.

Oil/Gas Production Tax Regulations –

- AS 43.55 – 15 AAC 55 – Oil and Gas Production Tax

- 15 AAC 55.171(f) – Marine Location Differential

- 15 AAC 55.250-271,800,900 – Deductible Lease Expenditures

- 5 AAC 55.350 – Alternative Tax Credit for Exploration

- HB280 – Cook Inlet Recovery Act

- Relating to a gas storage facility; relating to the Regulatory Commission of Alaska; relating to the participation by the attorney general in a matter involving the approval of a rate or a gas supply contract; relating to an income tax credit for a gas storage facility; relating to oil and gas production tax credits; relating to the powers and duties of the Alaska Oil and Gas Conservation Commission; relating to production tax credits for certain losses and expenditures, including exploration expenditures; relating to the powers and duties of the director of the division of lands and to lease fees for a gas storage facility on state land.

- SB236 – Education Tax Credit

- Relating to tax credits for cash contributions by taxpayers that are accepted for certain educational purposes and facilities; and providing for an effective date.

- SB309 – Interest Provisions, Jack-up Rig Credit, Cash Purchases of Credit Certificates

- Amending and extending the exploration and development incentive tax credit under the Alaska Net Income Tax Act for operators and working interest owners directly engaged in the exploration for and development of gas from a lease or property in the state.

- SB 21/MAPA – Passed in 2013, the “More Alaska Production Act” was an oil tax reform targeted toward boosting investment in and production from Alaska’s North Slope oil basin.

- See the attached SB21-MAPA document or the Fiscal Notes of SB 21 for detailed information relating to the new tax system.

- This Bill makes several changes to the oil and gas production tax system. Each of the major changes, along with its potential revenue impact, is discussed separately below. The effective date of each of the bill’s provision listed below is assumed to be January 1, 2014 with the exception of provision 6, which is effective for expenditures beginning January 1, 2013.

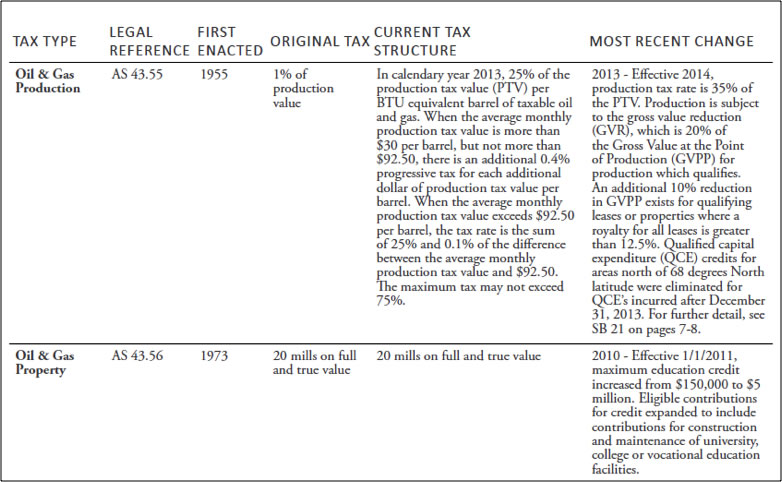

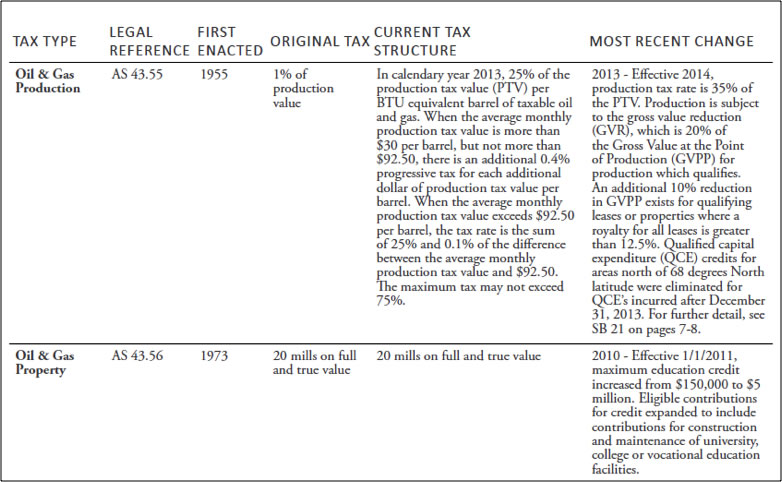

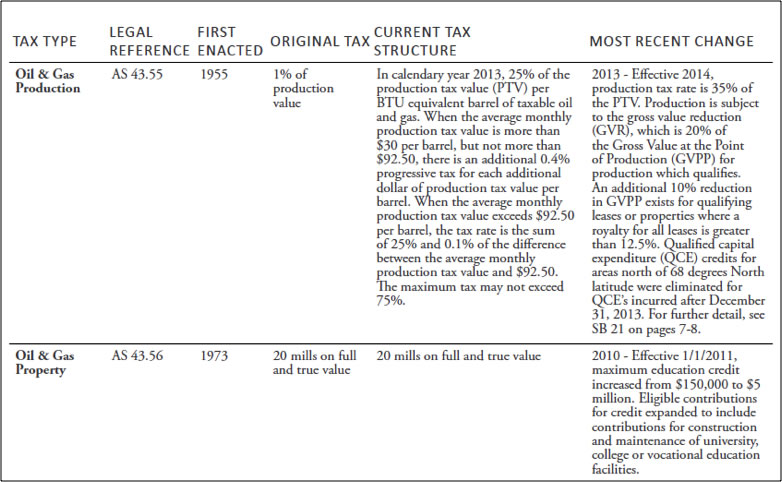

Tax Rates –

Research Papers –

- Tax Credits Information & Tables

- Annual Report

- The purpose of this report is to provide an overview of programs administered by the Tax Division (Division) and statistics of revenue collections and other information related to those programs.

- Indirect Expenditure Report

- The Alaska Indirect Expenditure Report is intended to provide information about expenditures made by the state that do not otherwise appear in the state budget. This report is submitted in accordance with AS 43.05.095 as a biennial report to the chairs of the Alaska State House and Senate finance committees and the legislative Finance Division. This requirement was enacted as part of House Bill 306, passed by the Alaska Legislature in 2014.

- Revenue Sources Book

- Intended to provide the Governor, the Alaska Legislature and Alaskans with a report of historic, current, and estimated future state revenue. This publication is prepared primarily by the Economic Research Group, a part of the Tax Division in the Department of Revenue, in accordance with AS 37.07.060.

- Shared Taxes and Fee Report

- Alaska statutes provide that a percentage of revenue collected from certain taxes and license fees shall be shared with municipalities in Alaska. The Tax Division within the Department of Revenue is responsible for accounting for taxes and fees subject to sharing and disbursing shared amounts to respective municipalities.

Tax Forms –

- Production Tax Refund Request Form

- This form must be completed, signed, and submitted via the Online Tax Information System (OTIS) at www.tax.alaska.gov.

- Alaska Supplemental Cost Report

- The Supplemental Cost Report is due annually from all producers and explorers on March 31 of each year for the previous calendar year.

- Alaska Producer’s Affidavit

- Pursuant to 15 AAC 55.151

- Monthly Information Report

- This form is to be used to report monthly information relating to volumes and values of oil and gas produced, lease expenditures incurred for oil exploration, development, and production operations, production tax credits, and tax amounts remitted. Every entity (corporate level) involved in oil and gas operations is required to fill out and file this report monthly (15 AAC 55.520(f)).

- Alaska Oil & Gas Production Tax Annual Return

- To complete the form and calculate the tax due a person need only enter the required information into the eight input forms (Tabs 2-9). The tax return will link the input data to the appropriate tab(s) necessary to calculate the tax levied by AS 43.55.011. Detailed instructions for filling in the forms and calculating the tax are provided.

- Annual Information Report (AS 43.55)

- This interim form is to be used to report annual information relating to volumes and values of oil and gas produced, lease expenditures incurred for oil exploration, development, and production operations, production tax credits and tax amounts due. Every entity (corporate level) involved in oil and gas operations is required to fill out and file this report annually. If one or more tax credits are claimed for the year forms as required by 15 AAC 55.345 must also be filed with this report.

Credit Forms –

- Additional Nontransferable Tax Credit Under AS 43.55.024(a)

- Alaska Oil and Gas Production Tax Credit

- Certificates issued under AS 43.55.023 & AS 43.455.025 – Applied to Tax under AS 43.55.011(e)

- Under AS 43.55.025 – Applied to Tax under AS 43.55.011(e) BEFORE it is issued as a certificate.

- Under AS 43.55.023

- Alaska Oil and Gas Production Tax Education Credit

- Alternative Tax Credit for Oil and Gas Exploration under AS 43.55.025

- Application for Cash Purchase of Alaska Oil and Gas Production Tax Credit Certificates Under AS 43.55.028

- Notice of Assignment of Tax Credit Certificates Under AS 43.55.029

- Notice of Transfer of Alaska Oil and Gas Production Tax Credit Certificate under AS 43.55.023 and AS 43.55.025

Oil and Gas Property Tax –

- Statutes

- AS 43.56 – Oil and Gas Exploration, Production and Pipeline Transportation Property Taxes

- Forms

- Alaska Oil and Gas Property Tax Education Credit (AS 43.56.018)

- Business Property Statement

- Every person having ownership or control of taxable property within the state shall file a written property statement on a form prescribed by the Department. Report total costs of all taxable assets. Any variation from exact ledger balance must be supported by supplemental schedules. Information contained in the Business Property Statement will be held confidential by the assessor.